Good morning, and thanks for spending part of your day with Extra Points.

I’ve got a fun announcement to share. Join us this Thursday, October 30th, for a free video conference chat with me, and Kyle Rowland, our new editor of NIL Wire. This will be an informal conversation where Extra Points subscribers can ask us questions, get to know Kyle a little better, and network with each other. Unlike previous Office Hours, our October event is free to all Extra Points subscribers, not just premium subscribers.

We’ll share the exact link once we get a little closer. But in the meantime, RSVPing does help us a lot. See you then!

Will you be able to make Office Hours with Matt Brown on Thursday 10/30/25 at 5:30 CT?

Last month, FOS and other outlets reported that Sequence Equity, a private equity firm, pitched college sports administrators about a plan to potentially move the FCS Playoffs out of the purview of the NCAA and into a new entity.

At a high level, this proposal would create a new entity to operate the FCS Playoff, just like the CFP for the FBS institutions. The majority ownership interest of the FCS Playoff would be the leagues and schools, and then the PE firm takes a small piece in exchange for “tens of millions of dollars in investment.”

The PE firm works with the conferences and their various strategic partners to drive more revenue, everybody makes more money and everybody is happy. That’s the goal.

And I understand why FCS commissioners and school leaders would take that meeting. Everybody is under major revenue pressures in the House era, and the Missouri Valley Football Conference and the CAA don’t have the fat TV contracts or alumni bases that the Big Ten or SEC enjoy.

Over the last few weeks, I’ve spoken to multiple FCS commissioners and ADs with direct knowledge of the presentation, as well as other folks across the FCS football universe. None of the individuals I spoke with were willing to get into the specific policy proposals or financial figures discussed in the meeting, but were willing to chat at a high level about the current financial situation of the FCS Playoffs, and where things go from here. Those conversations have informed my thinking here.

There are typically three major kinds of assets that would be considered part of the FCS Playoff: the broadcast rights, ticketing/hospitality, and sponsorships. All three have potential to drive significantly more revenue, but all three also have significant obstacles.

Let's consider the media rights agreement

Typically, one of the largest revenue drivers for any collegiate postseason event comes from the media rights fee.

But there’s just one problem with the FCS Playoffs. Those TV rights have already been sold.

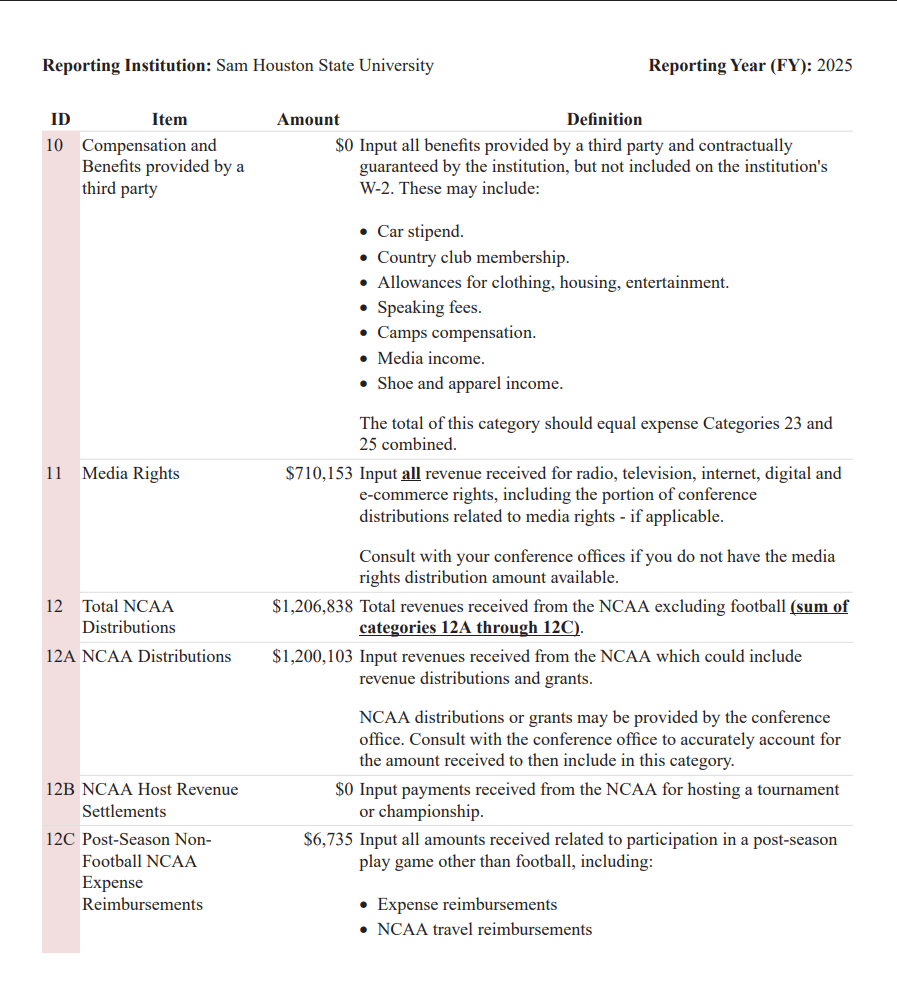

Back in January 2024, the NCAA announced a new, eight-year media rights agreement with ESPN to broadcast every NCAA championship event, from the women’s basketball tournament, to collegiate tennis and gymnastics. That package also includes the rights to broadcast the FCS Playoffs. This contract averages around $115 million a year in payouts to the NCAA.

So if any third party believed they could drive more media rights revenue than the current agreement, they would need to either a) wait until the agreement expires and negotiate an entirely new contract, b) push to renegotiate with ESPN, potentially offering other concessions in exchange for higher fees, or c) try to buy ESPN out of the deal.

Could any of those things potentially happen? Sure. But given that ESPN has the rights to the postseason locked up for the next several years (and likely at a favorable rate for ESPN), forcing the four-letter network to go back to the bargaining table may be difficult. From talking to a few commissioners and ADs over the last few weeks, I’m not sure if there would be much appetite in, say, moving the semifinals and championship into a less traditional broadcast window to try to juice ratings. So what cards do they have to play?

What about tickets and hospitality?

Part of the reason that many FCS teams currently lose money while participating in the FCS Playoffs is because even though almost all the games are held on campus sites, the hosting team doesn’t get to keep the ticket revenue. Almost all the gate goes to the NCAA.

Theoretically, an experienced investment partner could help not only improve ticket sales for the playoff games, but also provide more profitable “experiences” for high-dollar consumers. Think luxury boxes, custom tailgate setups, pregame events, etc.

There may be some truth to this. If the official attendance stats from the ESPN box scores of the 2024 FCS Playoffs were accurate, several opening round games were held in front of crowds far under stadium capacity. It would appear the same thing is true for the 2023 Playoffs. The championship game has been well attended over the last several years, as have later-round games, especially if those games involved programs like Montana State or North Dakota State.

My question, though, is about how much more revenue could potentially still be extracted from these games. Unlike P4 stadiums or mid-sized stadiums in professional sports, most FCS stadiums do not have much in the way of luxury or premium seating. Selling another 4,000 tickets would be awesome, especially if those 4,000 fans also decided to buy hot dogs, beers, and parking passes. But if all 4,000 of those fans are buying bleacher seats for an under $40 face value, it’s going to be harder to drive massive revenue increases.

So I’d be interested in what sorts of specific, strategic investments a third party could make to potentially improve ticketing revenue. Payouts to help schools make targeted stadium investments? Moving more playoff games to neutral sites (with better premium seating and hotel selections) and away from campus? Adjusting the price of tickets?

I believe there probably are options here to help monetize the event a little better. But given the size of your typical FCS stadium, what else is going on in the sports calendar, and the fanbases involved, I don’t think there’s some obvious solution to like, 4x revenues.

Speaking of revenues, let me quickly share a message from today’s sponsor….

More Taste and Quality – 100% Guaranteed

Hand-selected for quality and hand-carved by master butchers with over 900 years of combined experience, Omaha Steaks delivers heartland quality and unmatched value straight to Extra Points readers’ doors for free on any shipment of $99 or more!

From ocean-fresh, flash-frozen seafood to slowly air-chilled chicken and grass-fed, grain-finished beef (and everything in between), Omaha Steaks – America’s Original Butcher – guarantees absolute consistency in every single bite, every single time. In fact, they’re so confident you’ll love it, they back every single product with their 100% Satisfaction Guarantee.

If you aren't satisfied with your purchase from Omaha Steaks, for any reason, they will replace your order or refund your money, whichever you prefer. They’ve upheld this family promise for five generations and counting.

So that just leaves sponsorships, huh?

When I talk to almost anybody in college sports about finding and driving new revenues, the most enthusiastic responses typically center around sponsorships.

I get it. The current MMR model is evolving, and campus leaders express frustration about their ability to drive new sponsorship interest for their existing assets. If you slap some logos on stuff or throw up more billboards, you can enjoy the benefits of new revenue, without having to really burden your athletes or build a ton of new, expensive, stuff.

And if any third party is successful in driving more tickets and more broadcast exposure for the FCS Playoffs, well, that just makes the event even more valuable as a corporate branding asset, right?

But there’s a catch. The entity that currently has the rights to sell corporate packages for NCAA postseason events is….CBS and TNT. That agreement currently runs through 2032, and as I understand it, also includes the FCS Playoffs.

So if anybody else wanted to partner with a different entity to sell corporate activations with the FCS Playoff, well, they’d have the same problem with ESPN and broadcast rights. There would either need to be a negotiation, a buyout, or an agreement to simply wait out the contract.

Another question schools and conferences will need to decide…can any of this be done with the NCAA? Or at least, themselves?

Moving the FCS Playoffs out of the NCAA’s control and into a new entity is not without risks. While the FBS postseason has never really been part of the NCAA’s direct purview (all that CFP money? It doesn’t go to Indianapolis!), the I-AA (FCS) postseason has, and for decades.

Given that there have been multiple proposals floating around the industry for the US Soccer Federation to essentially take over collegiate men’s soccer, moving football away from the NCAA could trigger other sports to consider similar proposals.

That would undermine much of what still ties D-I together. After all, the current ESPN NCAA Championships media rights agreement is an explicit agreement to accept a likely lower rights fee for the premium events in the package (women’s basketball, FCS football, Softball and Baseball World Series, etc) in exchange for ESPN eating the production costs and agreeing to broadcast every championship.

If anybody else follows FCS football out the door, the rest of the contract could fall apart, leaving many schools, and sports, without traditional broadcast options. It could also potentially expedite breakaway efforts elsewhere.

There’s also nothing potentially stopping current FCS membership from taking steps within the NCAA to improve ticket sales, change travel reimbursement or gate control formulas, or renegotiate existing contracts with ESPN and/or CBS.

Now, if taking the steps needed to really generate meaningful new revenues requires a bunch of new capital…then yeah, FCS leagues will have to look at outside investment opportunities.

Is going private a good or a bad idea? I can’t say. I just think it’s worth being specific about the possibilities.

Without knowing the financial specifics, as well as what potential concessions may be considered to broker better terms with ESPN, CBS or other existing strategic partners, I don’t think I could offer an opinion about whether “going private” is a good or a bad idea. I don’t want to simply write EW PRIVATE EQUITY BAD. The risk exposure, strategic goals and financial terms are very different here than say, with the potential Big Ten deal, or deals that other conferences have considered.

I just think it’s useful to try to be specific when we talk about a postseason event, or really, any college athletic event, as under-monetized. Does that mean raising ticket prices, or playing in new stadiums? Does it mean new construction projects? New broadcast windows? (hello Wednesday Night National Title!) Is it more than just getting much better at corporate sales?

There’s almost certainly more juice to squeeze from many, many NCAA championship events, including FCS football. But how much more?

I don’t think it’s infinite, that’s for sure.